WHY GST IS BEING CONSIDERED AGAIN. To cushion the impact of the GST hike the Government will add S640 million to the S6 billion Assurance Package announced in.

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

GST reintroduction needs to be implemented in a targeted way - Subromaniam 02062022 0755 PM KUALA LUMPUR June 2 Bernama -- The reintroduction of the goods and services tax GST to replace the sales and services tax SST must be implemented in a targeted manner so as not to burden the people who are facing rising inflation.

. The GST which was seen by some as an effective way to increase the countrys revenue was implemented by the Barisan Nasional government in April 2015 but was scrapped by Pakatan Harapan after it took federal power in 2018. The GST was implemented on 1 April 2015. The tax should be implemented to help tackle the peoples economic problems and curb the excessive rise in prices for certain basic necessities he told Bernama here today.

Taxable and non-taxable sales. Check GST rates registration returns certification and latest news on GST. Universiti Tun Abdul Razak lecturer Barjoyai Bardai said although the tax had been implemented before more study needs to be done on the.

It can be used as reverse GST calculator too. The income from the newly implemented GST managed to supplant Malaysias national budget from the deficit induced by a loss in oil tax revenue. Welcome to the 2019 edition of Guide to VATGST in Asia Pacific an essential reference for a reliable summary and easy access to information on the Value Added Tax VAT and Goods and.

But there were signs of recovery in 2021 as the economy grew by 31 per cent. Signup for a Free Trial. Know all about Invoice under GST.

GST - Know about Goods and Services Tax in India with various types and benefits. Sales and Service Tax regime implemented in Malaysia from 1 September 2018 which replaced the GST system. In 2020 Malaysias economy contracted by 56 per cent due to the pandemic.

Employment laws in Malaysia provides standard conditions for specific types of employees working in this nation. In Australia the system was introduced in 2000 to replace the Federal Wholesale Tax. The GST Act is modelled off the UK VAT legislation and New Zealand GST legislation.

2022 BMW i4 M50 in Malaysia electric M-car 544 PS 0-100 kmh 39 secs. The Centre and the State used to. GST was implemented in New Zealand in 1986.

Further e-Invoicing system is also being implemented in a phased manner that requires certain more mandatory fields. By June 2015 worldwide crude oil prices fell to half its value with several nations oil industries considering it a crisis. We are also pleased to include Sri Lanka in this.

Rajya Sabha then passed 4 supplementary GST Bills and the new tax regime implemented on 1st July 2017. ClearTax GST Software simplifies GST Return Filing GST Invoices and provides Free Hands on GST Training to Tax Experts Businesses. The Employment Act 1955 Malaysia is the core legislation approved for the welfare and all relevant aspects of employee in Malaysia.

An economist has hailed the goods and. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice. These are applicable for native labors who are actively serving various businesses in this country.

The reintroduction of the goods and services tax GST to replace the sales and service tax SST must be implemented in a targeted manner so as not to burden the people who are. Bernama pic PETALING JAYA. GST is a value-added tax in Malaysia that came into effect in 2015.

A hidden Manufacturers Sales Tax was replaced by GST in Canada in the year 1991. The app allows a smooth integration of data between Tally and the ClearTax. In Singapore GST was implemented in 1994.

KUALA LUMPUR June 2 The reintroduction of the goods and services tax GST to replace the sales and services tax SST must be implemented in a targeted manner so as not to burden the people who are facing rising inflation. The tax invoice issued must clearly mention information under the following 16 headings. Rule 46 of the CGST Rules deals with the contents of invoice.

The Inland Revenue Authority of Singapore IRAS acts as the agent of the Singapore government and administers assesses collects and enforces payment of GST. Economists disagree with reintroduction of GST. To make sure wont do the same issues again for the first time when gst was implemented take a look this link.

The Goods and Services Tax GST was implemented on 1st April 1994 in Singapore. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax. Information Required in a GST Invoice.

GST was first introduced in Malaysia on April 1 2015 at six per cent but it was suspended on June 1 2018 and finally abolished and replaced by SST on Sept 1. Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax imposed on a wide variety of goods while the Service Tax was levied on customers who consumed certain taxable services. This is universal free online GST Calculator for any country where Goods and Services tax GST is implemented.

History of GST in India. According to former director-general of the Royal Malaysian Customs. Tax invoices sets out the information requirements for a tax invoice in more detail.

Tax Laws Before the Implementation of GST. GSTR 20131 Goods and services tax. Any new taxation system also needs to be approved by Parliament and if we take into consideration the requirement for public engagement as well as improvements to the existing system it is doubtful that the GST could be implemented this year he said in the 98th Laporan Kewangan Rakyat LKR released today.

2 days agoMore than 170 nations across the world have implemented some form of a value-added tax system similar to GST says an expert. Once implemented it will be reflected under Utilities as ClearTax integration.

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

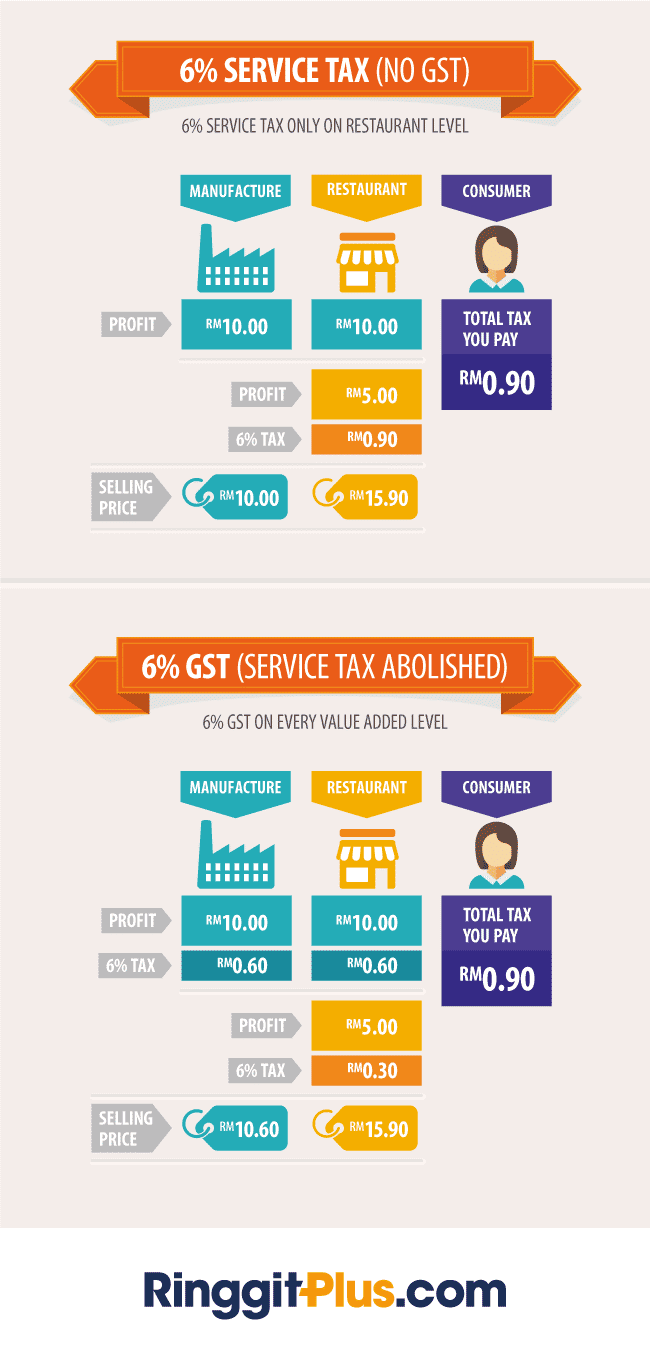

Gst Vs Sst In Malaysia Mypf My

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

A Guide To Gst In Malaysia How Does It Affect Me

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

1 Gst Charge At Each Level Of Supply Chain Source Royal Malaysian Download Scientific Diagram

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Goods And Services Tax Malaysia Gst Ts Dr Mohd Nur Asmawisham Bin Alel

Gst Better Than Sst Say Experts

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

Gst Vs Sst In Malaysia Mypf My